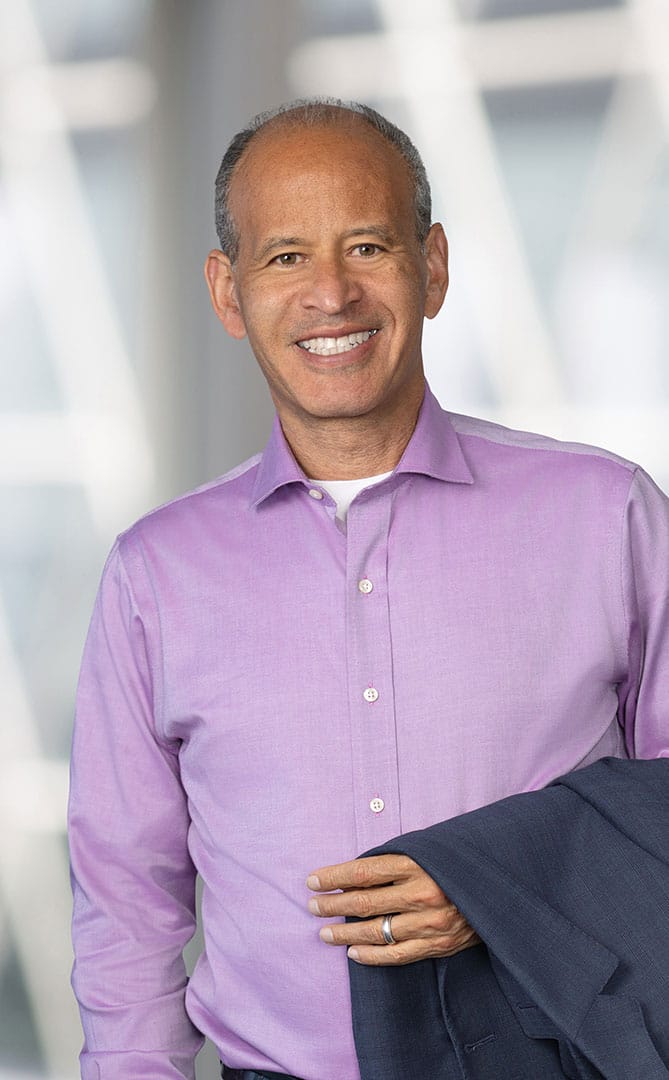

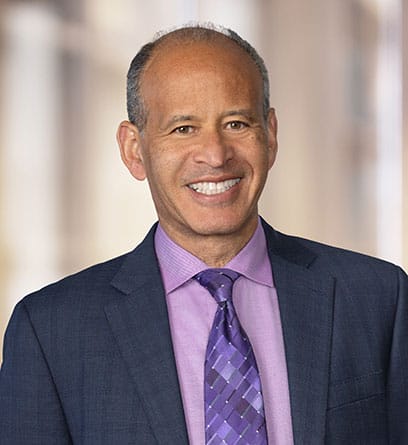

Simply stated, Fred Richards’ mission is to reduce real estate taxes, representing prominent developers, buyers and sellers of complex properties as well as major financial institutions.

Fred represents developers and buyers/sellers of office complexes, commercial and industrial properties, national hotel chains, multifamily housing and many others. He regularly advises on the tax consequences of prospective real estate transactions and develops innovative strategies to minimize associated tax liability. He also leads tax appeals before administrative judges, boards of review and appeal boards, having reduced taxable valuations by billions of dollars and tax liabilities by many millions.

A member of Thompson Coburn’s renowned Real Estate Tax Assessment group, Fred always looks at valuations with a broad and strategic perspective, often bringing novel and compelling arguments to valuation reviews and appeals. In one example, on behalf of a hotel, Fred reduced valuation by describing unusual problems associated with a neighboring property. He also obtains significant assessment and tax reductions for major financial institutions by analyzing their portfolios of bank-owned properties.

Clients appreciate Fred’s directness and tenacity. Even if no reduction in valuation is possible, he will have a plan in place, never putting a client “in a spot I wouldn’t want to be in myself.” His readiness with a solution is one reason clients have told him they would rather pay his fee than engage another lawyer at a highly discounted rate or even free.

Fred likes to mention that he comes from a long line of real estate folks. His family was among the founders in 1947 of Sag Harbor’s African-American Azurest community on Long Island, New York—the region’s first subdivision developed by African-Americans. Also continuing in that tradition, Fred is proud to serve on both the firm’s Diversity Committee and the Thomas F. Eagleton Scholarship Committee.

Professional

- American Bar Association

- Association of Defense Trial Attorneys

- Chicago Bar Association

Community

- Chicago Park District

- Angel City Links Alumni Scholarship, Former Chairman

- Listed in Illinois Super Lawyers, 2013-2020; 2022-2024 (by Thomson Reuters)

- “Real Estate Tax Appeal Analysis and Valuation Perspective for the Property Owner”;

2010 - “Ocean Dumping: An International and Domestic Perspective”;

Notre Dame Journal of Legislation, 1991

- “Understanding the Tax Appeal Process in Illinois and Training to be an Astronaut, Which is Easier?”;

BMO Harris Bank 2017 - “Diversity and Inclusion in the Workplace”;

CNA’s African American Employee Resource Group (AAERG) 2010 - “Valuing Residential Property in a Down Economy”;

2010 - “What Every Lawyer Should Know About the Real Estate Tax”;

TCFH Seminar, 2008

I indulge in water activities during the summer, whether it’s sailing, water skiing, or snorkling in Sag Harbor or the Caribbean islands. In the winter, I embrace the slopes, skiing in Telluride or Breckenridge.